(877) 806-8728

Professional Services Backed By Our Guarantee

Insulation and Home Energy Services

Our highly trained technicians are committed to providing top-notch home energy solutions. We meticulously install quality products to ensure you experience noticeable improvements in your home's energy efficiency. Your satisfaction is our priority. If you're not completely satisfied, we'll revisit areas until they meet your expectations and deliver the results you desire. We strive to make sure all work is performed to the highest standard.

According to the North American Insulation Manufacturers Association (NAIMA) there are roughly 90% of existing homes that are under insulated. That means that you have a 9/10 chance your home is under insulated as well. These homes are wasting energy, wasting money, uncomfortable and in need of some serious insulation. Low attic insulation sets home owners up for a losing battle during the heat in the summer and cold in the winter. This is where we can help.

Our highly trained professional consultants, experts, and installers can assess your insulation needs and give you the best options available to turn your home into the most efficient, comfortable, and cleanest home on the block.

Benefits to properly insulated attics:

Reduce heating and cooling cost by 20-50%

Improve energy efficiency

Extended service life of air conditioner and furnace (they won't have to work nearly as hard)

Smaller carbon footprint

Add resale value to your home

Improve overall home comfort

Small penetrations in your home’s ceiling, walls and floors all reduce your home’s indoor air quality, reduce the effectiveness of your insulation, and contribute to wasting more energy and money. Our skilled technicians will find and seal these penetrations so you can start enjoying the benefits of having your home more comfortable and energy efficient.

Main things we look for in the attic to seal up are around pipes, holes (from electrical wires), duct boots, outlets and top plates. We use an expandable foam to seal up off all of these hard to get penetrations.

Benefits of proper air sealing:

Improves the indoor air quality by keeping allergens, dust, and air pollutants out

Makes insulation more effective

Reduces exposure to moisture in your home preventing mold

Improves comfort through reducing drafty areas

Cut heating and cooling cost up to 30%

Attic ventilation is one of the most important things that you need to consider when you think about re-insulating your attic. An improperly ventilated attic will cause excessive amounts of radiant heat to build up which makes cooling your home down in the summer a losing battle. In the winter an improperly ventilated attic will cause moisture and mold to build up in the attic. Without a properly ventilated attic it is impossible to get your attics temperature under control.

At Elevate we make sure that your attic is venting properly and breathing like it should. We do this by adding baffles to soffits vents where there are none or where the baffle is damaged and not working properly. We also do this by adding a solar attic fan to the roof. The solar attic fan is one of the best ways to exhaust out all the compounding heat that builds up in the summer and get rid of unwanted moisture from the winter months. The solar attic fan not only helps the attic vent more efficiently but it cuts cost on your utility bill. The solar attic fan also qualifies for a solar tax credit which will reduce the cost of the project and make it more affordable for everyone.

Every Home has air leaks throughout the house where they are losing energy and wasting money. Our blower door test will help us to see how much energy is being lost in comparison to the size of your house. We do this by depressurizing the house and recording the number of air changes per hour. The blower door test will be performed before and after we air seal to show you the difference our air sealing has made on your home.

Health and safety of our customers is our top priority. This is why the Combustion Appliance Zone or CAZ test is so important. The CAZ test is where we put your furnace, water heater, wall/floor heater, and/or boiler under the worst case scenario to see if they are leaking Carbon Monoxide (Co) into your house. This test is to make sure that all appliances are draftings and working properly. This test is performed by professionally BPI trained technicians.

Request a Free In-Home Energy Audit Today

Our experts will assess your home's insulation and energy systems, offering tailored solutions to reduce your environmental impact and lower your bills. Schedule your free audit today.

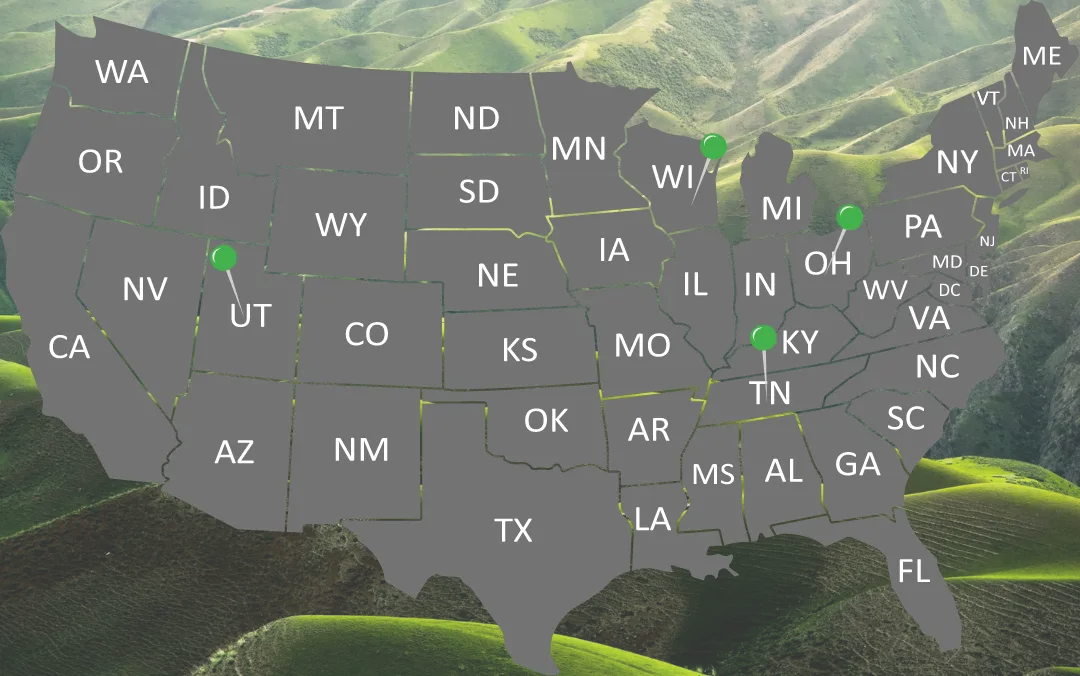

Our Service Areas

We are currently servicing the following areas:

Call for pricing (877) 806-8728

Advantages for Elevating Energy Efficiency

Your local utility providers are offering tax credits and rebates for increasing your energy efficiency!

Our Results Speak for Themselves

"This company went above and beyond for the work that was performed at my home. The employees were friendly and professional. Elevate is the only company I would recommend for attic insulating jobs!"

John Hixenbaugh

"I was very pleased with the professional and efficient way the insulation was installed. All of the people involved were polite and very neat with their work."

Patty Laroe

"Elevate Insulation did a great job. On time, professional, polite and efficient. They got in and got the job done. The crew cleaned up after themselves when it was completed. I would definitely recommend them."

Jim Pezzot

"This company went above and beyond for the work that was performed at my home. The employees were friendly and professional. Elevate is the only company I would recommend for attic insulating jobs!"

Bonnie Lindner

Decrease Your Gas Bill Today: (877) 806-8728

Now Hiring

We are always looking for dedicated individuals to join our team in elevating home efficiency.

For employment opportunities, give us a call today!

Contact Us (877) 806-8728

Copyright © 2022 Elevate Insulation LLC. All rights reserved.